Hunt 365, February 2017 Buying Recreational Land, Part II (A version of this article is published in the February 2017 issue of Iowa Sportsman Magazine)

In last month’s issue, I was purposefully vague in beginning to break down what it takes to be successful in buying recreational land. I hope as you read the article, you were starting to pull together a plan of your own if you are starting the process of buying hunting land. That plan should have included a whole list of questions and information you would need to start gathering; not to mention all the homework and educating a buyer has to do for themselves. For most hunters, getting this right is a huge financial decision.

In Part II, I am going to get more detailed pulling from my experiences in searching for recreational land. I will say this before I get into the meat and potatoes…I did not go into my search as an investor looking to buy a piece of land and flip it for profit. Instead, I went into the process as a hunter looking for a great whitetail hunting property recognizing that the only way I could financially afford a purchase this big was if it doubled as a good long term investment. (In other words, I didn’t nor do most hunters have hundreds of thousands of dollars they can use solely on deer hunting.) This is important to note because during my search, there were several properties that literally tore at my emotions because I knew they were great farms for deer hunting…but because they offered little in the way of income or investment I was forced to pass. So as you read these tips or opinions, understanding my motives will help you appreciate why I looked for certain properties over others.

Turn Key or Not?

When I started my search, I went into it unknowingly ignorant (I was ignorant and didn’t know it) and somewhat naïve. I didn’t know how to value land so much, and was drawn to the properties that were marketed as great…already set up (turnkey)…whitetail hunting meccas. I was like the newly licensed 16 year old looking for my first shiny car. Only the stakes were considerably higher! I was lucky that my instincts and my nature of being obsessively frugal kicked in and it didn’t take me long to figure out I needed to do some homework or be taken advantage of by marketing aimed at making the sale. So should you go into this looking for the marketed “turnkey” farm? For me it was a resounding NO…but that’s me. Once again I look to an outside perspective to answer this question.

“It’s going to depend on the person. If they don’t have the vision and the ability to perform the work, or pay someone to do it, they won’t be happy with a rough farm” says Jason Hull of Mossy Oak Properties, Boley Real Estate. “Many, many people know what they want, but have no idea how to get there. It can also be the quickest path from point “A” to point “B” if you buy a farm with many things already started or done for you ahead of time. However, great satisfaction can come from shaping the property into your dream property. Also, if you want to build equity, it is probably easier done with the purchase of a “rough” farm as opposed to a “turnkey” farm. More often than not though the “turnkey” property will fetch at least market value; it’s tough to find a bargain on these types of properties.”

I started out looking at the farms that were marketed turnkey myself. But I quickly learned that I would be paying a premium for a farm marketed as turnkey. And in many respects, these farms weren’t all that set up any way. Just because there are existing food plots and tree stands on the farm, doesn’t mean the owner you are buying from knew what they were doing in the first place. In fact, once I forced myself to remove the emotions from buying recreational land, it actually made much more sense to me to buy a property that had very little if any hunting type improvements on them at all. After all, the enjoyment from owning your own property for most hunters is the idea of managing the farm, hanging your own stands, planning out food plots, creating thickets of bedding cover…you get the idea. I spend so much time on this “turnkey” issue…or farms marketed as great hunting paradises because our emotions can get us in trouble in so many ways as consumers; buying land is no different.

Valuing Hunting Land

Like buying a used car, everyone wants a deal. Buying hunting land is no different. Unless you are buying from a relative, friend, or neighbor you’ve known for a long time, these great deals we all hear about where a farm is bought for half price just doesn’t happen all that much. Buying almost any other consumer good is relatively easy to determine price…do a search for a 1991 Ford F150 (that’s my truck) and you’ll get a pretty good idea what they’re going for. But land is so different. Farm income makes a huge impact…how do you determine it? Is there timber value? Will the land’s value grow over time as an investment? Does the price per acre matter? The answer is that it all matters!

Valuing Farm Land-Hunting land with tillable acres on it is desirable for a few different reasons. Tillable acres usually create or have edges, corners, points, fence lines, funnels, and other features making hunting easier. And, deer love diverse habitat with these same features. Conversely, a solid block of timber is hard to hunt by comparison (my opinion of course). So, I always recommend looking for a farm with at least a portion of the acres in open, tillable ground. More tillable acres results in more income from farm rents or conservation programs…usually resulting in a higher price per acre. The quality of the tillable ground also matters. Rocky, sloped, or poorly drained soils are hard to farm and obtain good yields…thus they don’t rent high. Tillable ground that has been improved through tiling or terracing usually yields better and will pay higher rents. This is all important because your return on your investment is what will make or break a deal for many hunters looking to own their own farm.

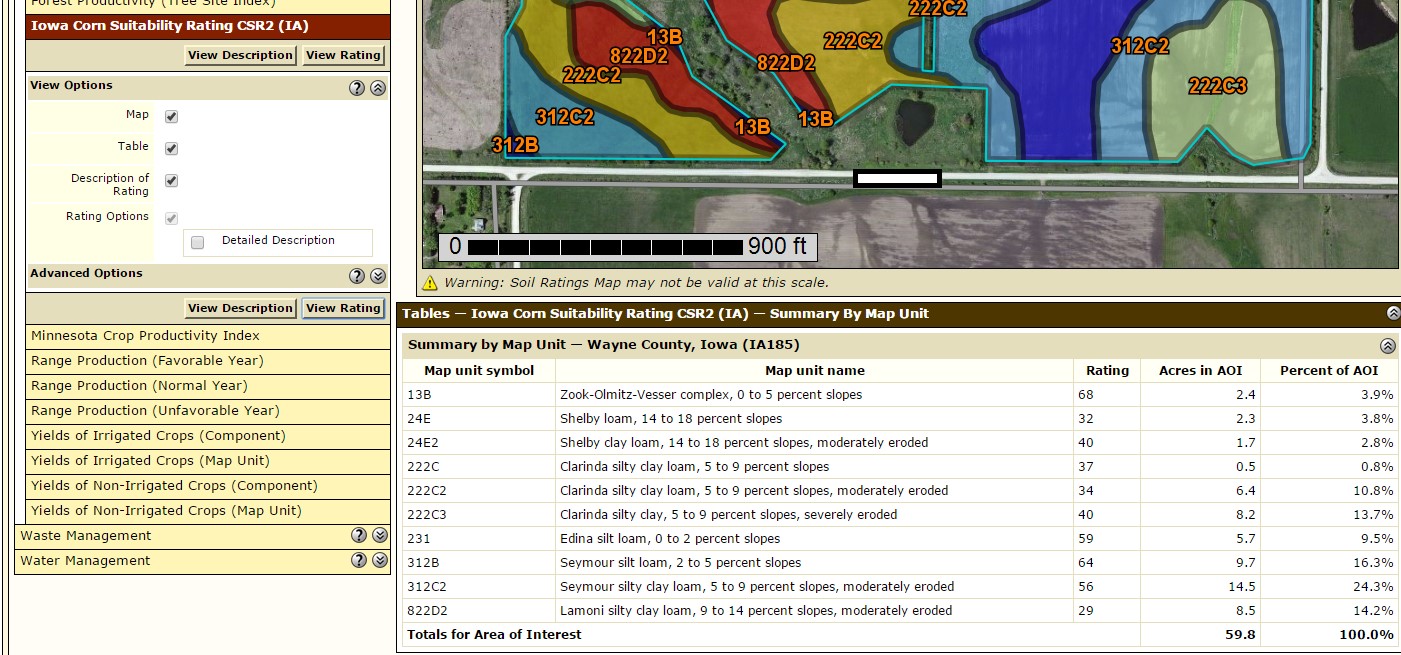

Iowa is unique when determining the quality of farm ground. Iowa uses the corn suitability rating or CSR (more recently CSR2) developed by Iowa State University in the early 1970’s as a way to determine soil productivity. It is only a single measure, but it can give any buyer a sense of what the value of the land is. Any realtor (or buyer’s advocate as I call them) that is representing you in this process should know how to value farm land and use CRS2 as one means to calculate value. For example, when I started looking for my first farm, I didn’t fully understand why some tillable ground was priced thousands of dollars more per acre than others. Once again, Jason pointed me in the right direction by explaining how you can broadly value farm ground using CSR. “CSR is one way to objectively get a good feel for the value of tillable ground. To value the tillable portion of a farm, take its CSR value and multiply it by price per CSR point for that area. A few years ago I used $100 or even $110 per CSR point…but now it is somewhere closer to $90 with lower commodity prices. Therefore, ground with a CSR of 50 is worth somewhere around $4500/acre”. Other factors like access to the tillable ground, size and shape of the fields, and local competition can have impacts on price as well.

Iowa uses CSR2 as a way of measuring soil fertility. Other states use other ways to measure soil fertility. Learn how to use these measures to determine the return of the farm ground on a farm you’re interested in.

Another great way to value farm ground is to look at its income. The more income potential the greater a farm’s value. From my searches over the past 4 years, it seems reasonable to expect a 3 or 4 percent return on your money, but only if buying a farm with a good portion in tillable acres. If you want mostly timber and draws, your income will be minimal. This is one significant reason I only looked at properties with high ratios of tillable ground. Simply put, I think it is easier to hunt farms with more tillable ground and the income I receive makes the investment side of the purchase possible. Two great ways to determine potential income are looking up cash rental rates for your county and by comparing average rental rates to comparable conservation payments like CRP. Any realtor who knows farm land should be able to help you with this. (If they can’t…dump them)

Simply put then, a farm with potential income of $10,000/year in rental leases or conservation payments is worth about $285,000 (at 3.5%) if it also shows good hunting potential. It takes work to find these properties…but they do exist. Case in point, I’ll use my second Iowa farm as an example.

In 2012 we bought our first Iowa farm that had very little income on it. This was a known conscious decision. So, after that purchase we knew our second farm had to be one that had good investment quality…mainly farm income. We looked at dozens of farms in areas I was comfortable in, made offers on a couple we didn’t get, and then one day I saw a mostly tillable farm while doing yet another internet search. It was in a great area I had hunted in the past. I called Jason to get some CSR maps, find out about the current farm practices, and asked him to give the listing agent a call about us walking the farm the coming weekend. By this time, Jason knew what I was looking for and what information I needed before I did my “scouting”. Amy and I walked the property on a Saturday morning and I found exactly what I needed to see…Good crops, good tillable acres, big rubs, beds, and the habitat potential was all there. I also noted no sign of other hunters directly on fence lines or using this property. So, removing all emotions from the deal, I knew the area was good, the potential existed…but what was the property really worth?

When I’m walking a new property to buy I look for great habitat or habitat potential, and sign of big bucks. Large rubs are a great indicator of big deer on the property.

Average per acre values for the county were about $3500/acre. That is the first broad thing I looked at.—–Next, the property was 80 acres in size with 60 acres of tillable having a weighted average of 48 CSR2…at $90/CSR2 point…that came out to $4320/acre for those 60 tillable acres or about $259,000. That’s an objective value using a CSR calculation.—–Finally, by contacting the NRCS and calculating potential CRP payments I came up with potential income of around $180/acre or total income of $10,800. This income potential was within the published rental rates for the county. Subtracting yearly maintenance and taxes and I conservatively put the farm income at $9000/year. Follow me so far? Now, because I think it is reasonable to get 3-4% return, I take $9000/.035 (that’s 3.5%) and my value using income is about $257,000 or about $3200 an acre. I now have three ways to measure value of this land…county average, CSR calculation, and income calculation. The awesome hunting potential is the added bonus! A fair and reasonable price (in my opinion) for this farm would be somewhere between $257,000 and $280,000. We put an offer in on the farm and got it in that price range; and secured a 3 year lease agreement from the farmer selling the property. Some would argue we didn’t get a smoking deal…we didn’t. We didn’t get burned either. We got exactly what we were looking for at a fair price, and we can’t wait to start hanging stands! (Note: If you can’t figure out how to do all this stuff yourself; you need to find an advocate (realtor) who can do it for you. Some can do it, most can’t!)

Next month, I will be taking one final look at purchasing recreational properties in Part III, avoiding mistakes, hype, emotional tricks. If there’s one thing I’ve learned through my process of purchasing two Iowa farms is that it is easy to get caught up with your emotions.

(Author’s Note: I want to thank Jason Hull of Mossy Oak Properties, Boley Real Estate for contributions to this article. Jason is a licensed Realtor for Iowa and is also a friend of mine. He was my advocate representing me for two Iowa farm purchases since 2012. I received no monetary or other benefit for using him as a reference for this article. Without mentioning Jason by name would have been to plagiarize his ideas and knowledge.)